-

When you’re trying to first get a business loan, you need to remember that it’s not nearly as easy as it may seem. If it doesn’t seem easy you’ve caught the idea. Getting a business loan is not going to be simple, you need to be ready when you...

-

Fixed-rate mortgages are the most widely used form of home mortgage loans. It is a basic arrangement in which the lender calculates the principal amount, using a single interest rate, and then divides the sum equally over an agreed period of years. The most popular terms are 30-year and...

-

If you have an interest in making more money and preparing for your future finances, then you must be thinking about investing in the stock market. The stock market is a particular market where stocks and bonds are traded. The stock market also, according to the way some people refer...

-

Managing your payroll is one of the most difficult tasks while conducting any business. Some small business owners wish that there could be an automated software that could manage their enterprises’ payroll to reduce the associated headache and costs. However, since as a small business owner you need everything...

-

For many students, loans may be the only way to afford a college education. Unfortunately, loans can total thousands of dollars and become a financial burden to students when they are finally starting their careers. While some students are able to pay off their loans, others need the services...

-

You may end up declaring bankruptcy during a financial crisis, but it shouldn’t be taken lightly. This pros and cons list may help you discover whether filing for Chapter 7 or Chapter 13 bankruptcy is fitting for your situation. Pros of Declaring Bankruptcy Collections Stopped: Filing for bankruptcy stops...

-

Retirement shouldn’t be something that you leave until the last minute – it should be something that you start strategically planning as early as possible. Of course, that’s not always a priority for some. People begin preparing for retirement at all stages of life, and one of the most...

-

Starting a business is not a simple task; you put a lot at stake, including the entire investment amount. And you often require a lot more money to expand your business, and at times like these, it may be a sound idea to make use of a business credit...

-

If you would like to be able to get a loan without leaving the house, you’ll be happy to know there is a variety of loans you can find online. Here is an overview of the main five types of loans that are available through online lenders. Mortgages Most...

-

Overall Score 56.6 Net Monetary Value 44.3 Product Features 55.6 Customer Experience 100.0 Pros & Cons With the USA Triathlon Visa Rewards Credit Card, users earn unlimited reward points each year, although points expire after five years. In addition to points for all purchases, users earn extra points for...

-

If you are venturing out on your own and starting a new small business, you must be looking for a loan. There are alternatives to banks that people use to borrow money at much lower interest rates than the bank, commonly known as merchant cash advance (MCA). This was...

-

The Home Affordable Refinance Program (HARP) is a U.S. federal program that began in 2009. The goal of the program is to help struggling homeowners refinance their mortgages. The following is a short history of HARP and how the program continues today. The Crisis After the U.S. housing bubble...

-

Sending money across the United States and abroad is incredibly easy, especially with all the new technology. Unfortunately, criminals have come up with scams to get people to initiate wire transfers to tap into your bank account. Avoid falling victim to these scams by reading about some of the...

-

Cloud-based payroll service OnPay has greatly improved since the last few years, but it unbelievably gets the same rating year after year. Why is this so? Apparently, there has been a lot of competition. Starting with Gusto being their stiffest competition. In spite of all the challenges, OnPay is...

-

Student loans must be repaid. However, the federal government understands that you may not have the money to repay your loans when they are due. That’s why you have two options to suspend student loan payments: deferment or forbearance. A deferment is specific to the time which the interest...

-

Have you considered hiring a bankruptcy lawyer? You technically don’t need to hire an attorney to file for bankruptcy, but hiring an experienced, dedicated attorney is a wise decision. Before you shrug off the idea of hiring a lawyer, read these five advantages to having a bankruptcy lawyer work...

-

After dilly-dallying with your retirement plans for many years, it soon dawns on you that you too are bound for retirement. Woe unto you because you never prepared for your retirement. It was other people who were retiring and not you – or so you thought. As the years flew...

-

When it comes to applying for a loan, your credit is one of the most important factors; any responsible lender or organization would want to make sure you can comfortably afford to manage any new borrowing without overstretching. Many at times, relevant information on your personal file is used...

-

After taking a back seat to credit cards for many years, personal loans are popular once again. More and more people are turning to the lower, fixed rates of personal loans, especially after the most recent financial crisis. Personal loans can be used on just about anything, but there...

-

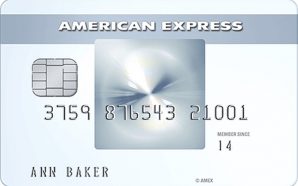

Overall Score 29.1 Net Monetary Value 23.7 Product Features 66.7 Customer Experience 29.4 Pros & Cons The U.S. Bank FlexPerks Gold American Express Card allows cardholders to earn the most points on purchases at restaurants, gas stations and on flights, as well as on other eligible card purchases. Points...

-

Congratulations on starting your own business! Now that the hard part is done, you probably need some personal loans to fund your business. There are some great places to get a personal loan (even personal loans with no questions asked) but you probably want to keep debt as low as...

-

Homeowners considering refinancing of their properties may qualify for an FHA streamlined refinance loan, cash-out refinance loan, or a no-cash refinance loan. According to FHA loan rules, applicants for a new mortgage must meet the eligibility criteria, not be the same party as the original loan, and reside on...

-

There are many types of daily trading, buying and selling stocks, and financial assets being the most noteworthy. If you’re looking to break into the market of trading, selling and buying stock online, it has become pretty easy these days thanks to the internet. The stock market game operates...

-

Wagepoint is a fast, smart and simplified online payroll service for small business application that enables employers and payroll managers in any organization to manage the salaries and wages of their employees and other stakeholders such as suppliers. This computer software is very ideal for small businesses mainly in...

-

Home equity loans are established to allow you to borrow against your home value. These loans suit people who need to borrow relatively large amounts of cash. They are easier to qualify for than any other forms of loans (since their house secures them). A home equity loan can...

-

Filing for bankruptcy is a big decision. It can get you out of a tough financial situation, but can you afford it? If money is tight, you may not be able to file as easily as you’d hoped. These are the general costs of filing for bankruptcy. Chapter...

-

You may not be thinking about it too much now, but good retirement planning starts now! In several years, you will begin a new chapter in the journey of life and it’s never too early to start thinking about it. While many people dread the thought of retirement as...

-

Simply a collection of stocks and/or bonds, a mutual fund is a company that invests the money belonging to a group of people in stocks, bonds, and other similar things. While these are generally very simple to buy, there’s a lot of planning done beforehand. There are seven different...

-

When you retire, everything about your daily schedule will change. Your life may become more relaxed and move slowly. Retirement may benefit you because you will lose work related stress. Apart from benefiting you, retirement can also be harmful to your health. How? Studies have shown that most people...

-

Overall Score 29.3 Net Monetary Value 8.8 Product Features 66.7 Customer Experience 82.4 Pros & Cons The Priceline Rewards Visa Card offers its users a choice of cash back, reward points or a discount on a hotel stay upon new account approval. The cardholders can earn maximum points on...

-

Setting up a small business or startup is a lucrative thought, but not an easy process. While the great American Dream talks about becoming successful regardless of your social standing and background, it doesn’t explain how to find the money to go about doing so! The availability of micro-loans...

-

If you’re in the process of starting a new small business and are hoping to open a business checking account, you need to ensure that your own personal finances are in order. If you are one of the millions of people around the US with a poor credit report,...

-

Many car buyers are committing a mistake when it comes to financing vehicle purchases because they are deciding on longer loan terms. Car loans with long terms of about six or seven years are becoming common. At some point, you may feel the need to get out of your...

-

A payday loan, also known as a “cash advance” loan, is a loan for a small amount, usually under $500, and is due on your next payday. The cost to receive a payday loan is high, at $10 to $30 for every $100 loaned. The average fee of $15...

-

Good car rental deals can be hard to find especially if you are only searching in limited places. However, doing some more research can bring about some reasonable savings you may not have found otherwise. You shouldn’t give name brand much recognition when renting a car – a Ford...

-

Taxes and bankruptcy are two complex matters that many people would rather not think about, let alone discuss. If you are contemplating bankruptcy, however, it is important to understand how the two impact each other. Many factors affect the relationship between bankruptcy and taxes. Bankruptcy law permits owed taxes...

-

A car title loan is a fast, easy way to get money using your car title instead of your credit score. When it comes to finding good information for car title loans, the online resources are important. The size of the title loan is normally determined by the amount...

-

The stock market is usually affected by various seasonal trends that no one can tell exactly when to buy stocks. An old saying “sell high buy low” is a strategy that does not focus on when to do it. However, understanding how the market operates is a great way...

-

Credit card debt consolidation can help you out of several different issues by compressing it into one. Basically, you can open a new line of credit, take out a new loan, or enroll in a debt management plan – whichever you decide on, you will use this newly acquired...

-

Overall Score 77.0 Net Monetary Value 82.0 Product Features 66.7 Customer Experience 64.7 Pros & Cons The Amex EveryDay Preferred Credit Card is ideal for earning rewards on everyday purchases. Card members earn the most points on purchases at supermarkets and gas stations, as well as some points on...

-

Capital is the lifeline of every business. For business start-ups or even existing owners, securing capital is key, especially for a small business. Many up and coming business owners find that being approved for business loans fast is a challenge and they don’t even know where to begin. Below...

-

Your credit score is always used by lenders to help to determine whether or not any applications you make for personal loans, credit cards, mortgages or any other form of borrowing, will be approved. But how do you find out what it is? We break down how to check...

-

A stock exchange is a place where buyers and sellers can trade shares of stock that are traded either publicly or privately. The stock is a portion of ownership of a particular company, and investors can decide on how many individual stocks they wish to purchase or sell at...

-

You’ve probably seen payday loans advertised on television or billboards. High dollar amounts instantly for just a small fee sounds tempting, but you need to know both the advantages and disadvantages to these loan types. Unlike a traditional bank loan, payday loans aren’t based on a credit score, instead...

-

A car title loan is a fast, easy way to get money using your car title instead of your credit score. When it comes to finding good information for car title loans, the online resources are important. The size of the title loan is normally determined by the amount...

-

If you’ve found that your cable bill has suddenly blown through the roof, or if the price you originally signed up to pay has become too much, of if you simply want to cut costs on your cable bill, take a look at these tips. Some of these have...

-

Did you know that most car title loan lenders can only offer car title loans online in a few states? Unlike payday loans, there are several state-specific differences at play when you are looking for the best car title loans. Car title loans online are continually becoming popular ways...

-

Getting a credit card for your small business can be the best thing you can do for your accounting department. There are many things, both good and bad, that you should know about small business credit before you fill out a small business credit card application. For example, you...

-

Debt consolidation is basically a form of refinancing to help people pay off their debts in a less stressful, and cheaper way. If you have several credit cards, bills, or personal loans that you just cannot pay off, you may need to consolidate your debt. Consolidating debt is when...

-

Overall Score 46.0 Net Monetary Value 56.1 Product Features 66.7 Customer Experience 0.0 Pros & Cons For travelers who prefer to fly in luxury can earn first-class miles with the TD First Class Visa Signature Credit Card. The cardholders earn the most miles on eligible travel and dining purchases,...