Are you looking for professional and user-friendly credit card processing services? Do you want a company with exceptional service terms and an easy-to-use application process, not to mention top-of-the-line customer service? Payline is one of the most top-rated and popular credit card merchant services in the industry. This article will look into what Payline can offer, including not only their pros and cons but also their features. Payline offers a wide arrary of benefits, payment plans and monthly costs options. Thanks to this, Payline is one of the best choices for credit card merchant services out there.

Source: marketingland.com

The Setup Process:

Payline’s application process is possibly one of the most user-friendly and fastest application processes around for merchant service credit cards. Payline doesn’t charge any application fees, so you can apply without any cost to you. To complete the application, you can go online to the Payline website and complete it within an estimated ten minutes. However, there are occasional cases where, depending on your information, your account may take a little longer to approve. Compared to its peers, it’s one of the fastest application processes there is, with less hassle or complications.

Payline Services:

Unlike most credit card merchant services that may require you to sign to a year-long contract, Payline is month-to-month basis payment plan. This allows you to pay for only the month that you use their credit card processing services, rather than paying for a whole year if you choose to only use it for a few months. Along with no cancellation fees, if you do happen to receive an application that says you are signing to a three-year contract for a merchant services account, mention this to a customer service rep and you will get a waiver that will circumvent that and allow you to get the month to month payment plan. If you decide that you no longer want to continue using Payline’s sacredit card processing services, they will not charge you an arm and a leg just to cancel; there is no cancellation charge or catch that might prevent you from canceling at any time you feel necessary. Payline is set up to connect businesses with their customers while enhancing their payment experience to be more pleasurable for both the company and the customer and this ensures effective and efficient functioning of both parties involved.

What are Payline’s Costs and Fees?

When it comes to Payline’s cost, they offer the Interchange-Plus Pricing. You can view this pricing plan on the Payline website, which will also show their quoted price at 0.20% + $0.10.

Retail is priced at 0.2%, $0.10 per transaction, and $15 a month, while Online is priced at 0.35%, $0.10 per transaction, and $15 per month. There is also an option where, if you are a business that brings in more than $80,000 a month, Payline will work with you to find you a payment solution that fits your needs. This is known as Enterprise. Payline also offers two different payment plans that you can choose from: Pro Plan that is usually used for businesses that will process over $5,000 every month and Payline’s Simple Plan for businesses that will bring in less than $5,000 a month. Payline offers a very strategic, but simple payment plans that are fitting for most business and/or people.

Source: paylinedata.com

Let’s not forget about those standard monthly fees that everyone charges. These include PCI-Compliance fees, monthly fees, and a minimum monthly fee. There may be quite a few, but before you freak out and panic, these fees are not outrageous. Payline’s monthly fee tends to be higher than most credit card merchant services at $20, with a monthly minimum of $25, which is about the same as any other, and a PCI-Compliance fee that is no higher than $99. There are perks of these fees being a little high, however. For example, the monthly minimum allows you to only need $25 worth of transactions for that month. This makes meeting the monthly minimum a lot easier.

Payline also offers online payments, which will cost you a setup fee and a monthly gateway fee along with a fee that you will have to pay for each transaction, depending on the transaction. If you become overwhelmed trying to remember all the fees, cost, and terms, they are all available on Payline’s website for reference at any time.

How is Payline’s Customer Service?

This is one of Payline’s most noticeable features. Payline’s Customer Service Representatives aren’t just incredibly helpful. They’re also friendly, know a lot about the company, and are genuinely interested in helping assist their customers. Payline offers 24/7 customer service phone support and there are live chats available for quick help on their website. This is one of the top areas where Payline really stands out and gets their greatest reviews.

Source: bestcompany.com

What about Pros and Cons?

While Payline may be one of the most top-rated credit card processing and merchant services out there, every company has some bad to tag along with the good. When it comes to the Pros of the company, their highest would be their two simple pricing plans. Firstly, they offer pricing plans for smaller businesses that may be low on funding. They offer another plan for companies that may want more out of the credit card processing service and have the money to spend on it. This allows Payline to bring in twice the customers than they would if they only offered high payment plans.

The Cons of the company are not that serious, as it just happens to be their fees. Payline’s monthly charges tend to be a bit higher than any other credit card merchant company. That said, when paired with their other exceptional features, it seems to almost even out. You get what you pay for; the more you pay, the better the service. The quality of service makes it just about worth it.

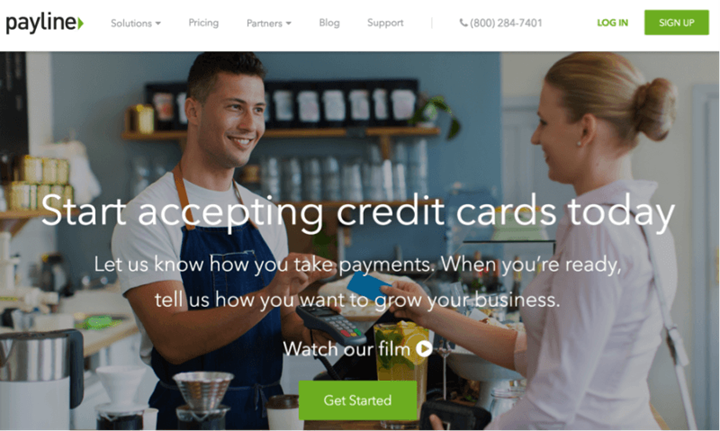

Featured Image Source: googleusercontent.com